New York, February 6, 2026 –

The Dow Jones Industrial Average (DJIA) marked a momentous milestone on Friday, closing above 50,000 for the first time in history as U.S. stock markets rallied sharply to cap a volatile trading week.

Investors cheered the broad-based advance that pushed the DJIA up 1,206.95 points, or more than 2.47%, finishing the session at 50,115.67, a psychologically significant level that underscores ongoing confidence in U.S. equities.

Market Drivers: Tech Rebound & AI Optimism

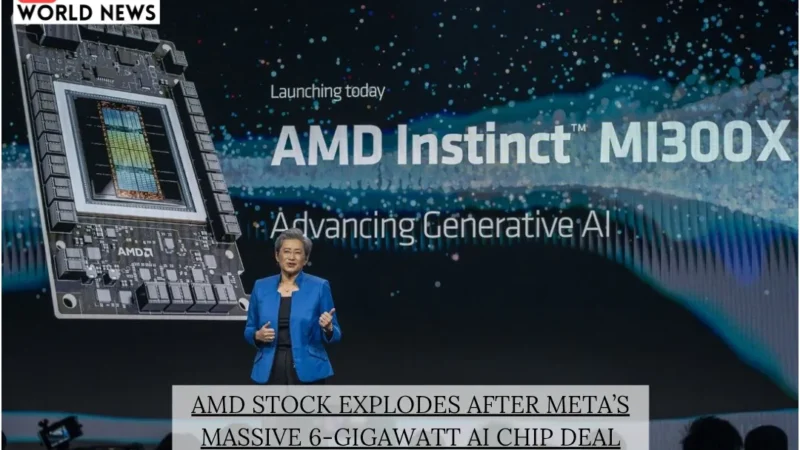

The rally was powered by a rebound in technology and industrial stocks after earlier losses this week. Leading chipmakers, including Nvidia, AMD and Broadcom, logged strong gains, with Nvidia jumping roughly 7.8% on expectations that AI spending will continue to fuel long-term demand.

Industrial giants such as Caterpillar also contributed, benefiting from rising demand for infrastructure and machinery, illustrating that the market’s strength isn’t limited solely to tech.

Sector Performance Snapshot (Friday):

- Dow Jones Industrial Average: +2.47%, closed above 50,000

- S&P 500: +1.97%

- Nasdaq Composite: +2.18%

This broad uptick lifted major U.S. indexes out of a recent slide sparked by tech sell-offs earlier in the week, reflecting a renewed appetite for risk-on assets.

Tech Stocks, Spending Plans & Market Sentiment

While many high-growth tech stocks rallied, some heavyweights like Amazon saw shares slide after projecting extensive capital expenditures focused on AI and robotics, which raised investor concerns about profit pressures.

Cryptocurrencies also played into market sentiment, with Bitcoin rebounding above $70,000 after recent volatility, providing confidence across risk assets.

What This Means for Investors

The Dow’s climb past 50,000 is a major psychological milestone but also reflects deeper dynamics:

- Rotation across sectors: Strength from industrials and semiconductors shows broader market participation beyond traditional tech leaders.

- AI future optimism: Long-term demand for AI infrastructure underpins confidence in chipmakers and enterprise tech.

- Mixed earnings impact: Some companies — especially those investing heavily in AI — face near-term stock headwinds.

Market analysts note that while crossing 50,000 is significant for sentiment, fundamental drivers like earnings growth and macroeconomic conditions will ultimately shape the next phase of the rally.

Dow Jones: A Historic Perspective

The Dow Jones Industrial Average, one of the oldest and most watched U.S. stock indexes, first closed above 40,000 in 2024 and has continued its steady ascent into 2026, culminating in this historic 50,000 milestone.

This milestone reflects decades of economic growth and a dynamic marketplace shaped by technological innovation, global policy shifts and evolving investor strategies.